A portfolio is a collection of investments or assets that are managed together. Generally, the goal is to spread risk and diversify investments to reduce volatility.

1) Equities: A share of ownership in a company that pays dividends and appreciates over time.

2) Fixed Income: A type of investment with an interest rate that does not change over time.

3) Derivatives: An investment with an underlying asset, such as stocks, currencies, commodities and market indexes.

4) Alternative Investments: Investments outside the traditional categories like real estate, venture capital, private equity and hedge funds.

Why Portfolios are Important for Investors

Portfolios are important to any investor. They can provide a way to track your investments, find opportunities and compare performance. But, what is the best way to create a portfolio?

There are Three main ways to build a portfolio:

1) The buy-and-hold strategy involves buying stocks that you believe in and holding onto them for years. This strategy can be good for investors who want to keep their money in the market but don’t want to have to constantly monitor it.

2) The other strategy is called “momentum trading” which means you buy stocks when they start performing well and sell them when they stop performing as well as they used too. This is good for investors who want more control over their money but don’t have time or interest in monitoring it all day.

3) The other strategy is “value investing” which means you buy stocks when they are at their lowest cost basis and sell them when they reach their highest point. This is good for investors who want to make money over the long term and are interested in building wealth instead of just quick profits.

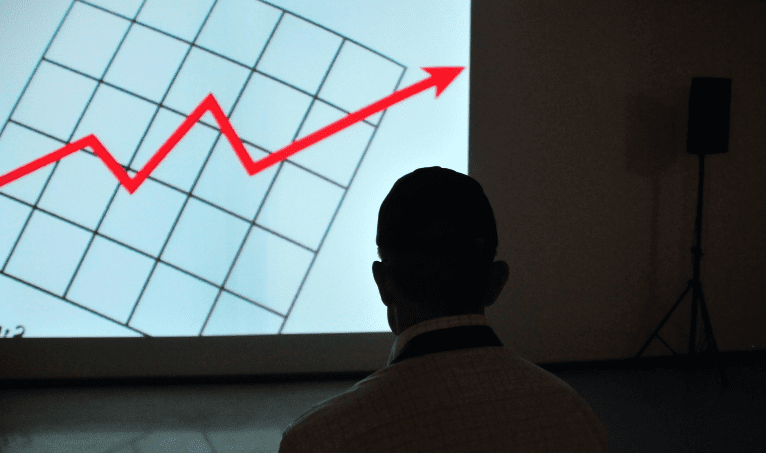

How to Navigate the Stock Market with the Help of a Solid Investment Strategy

The stock market is a highly volatile and unpredictable entity. There are many different strategies that investors can use to navigate it. The most popular strategies include value investing, growth investing, and momentum investing.

Value investing is a strategy in which investors buy shares of companies with a low price-to-earnings ratio and make money from the dividends. The investor only considers the company’s assets without considering its liabilities. You may refer stock market content aggregator websites like wealthbulls, moneycontrol & Wall street journal. There are also dedicated websites for trading, wealthbulls is one among them.

The investor typically buys shares whose price is lower than $3 per share, gradually builds up his/her holdings, and continues to reinvest any profits back into the stock until it becomes a better buy. Generally, value investors like to invest in companies that are viewed by others as cheap and have a low share price relative to their net profit.

These companies can be identified by using ratios such as price-to-earnings ratio and dividend yield.The main goal of value investing is to purchase stocks at a low price, in the hope that the company will grow.

Value Investing: Value investors try to identify stocks that are undervalued, or stocks that are trading for less than the company’s intrinsic value. This strategy is often used by people who like to buy stocks at a low price and sell them when they rise in price.

Absolute return: This strategy has been around since the 1930s and was originally used as a hedge against falling stock prices. The idea is to find stocks that are relatively stable and will always earn more money than a stock index like the S&P 500.

Absolute return investors are often better off when markets collapse, because their portfolio is more likely to yield returns in a downturn.A risk parity fund lets investors pick the percentage of their portfolio that will be invested in stocks, bonds and short-term cash investments like treasury bills and certificates of deposit.

This strategy seeks to replicate the market’s returns with a lower level of risk over time.Individual security selection: This strategy is similar to relative value investing, except that it seeks to invest in the cheapest stocks that meet certain criteria.

Growth Investing: Growth investors focus on companies with the potential for high growth rates. They buy shares of these companies in the hope of earning higher returns than they would with other investments such as bonds or cash-equivalents.

Historical Stock Data: The data from a company’s historical stock price.Holding Period: One period of time in which an investor holds onto shares of a company before selling them for another investment. The holding periods for stocks differ, and the length of each period depends on the investor’s risk tolerance.

Horse trading: Trading in shares that are not actively traded on a stock exchange.Investing: The process of making a financial decision based on the potential for long-term gain or loss.

Investment: A financial decision made with the expectation of earning income, either through cash flow from dividends or through capital appreciation, over an extended period of time. Leverage: The use of borrowed money, or a combination of borrowed and owner’s capital to increase the amount an investment.

Dividends: Cash that is generated by the company and distributed to shareholders through the payment of a set percentage of the company’s profit.A dividend is paid out either as a single lump sum or in smaller instalments over time.

Different Ways in Which You Can Invest Your Money

Investing is a complicated process that requires careful consideration and research. It’s not for everyone, but if you do decide to make an investment, it’s important to know the different options available to you.

The stock market has become the main form of investment in recent years, but it’s important to remember that there are many other types of investments that are available.StocksStocks are “pieces” of a company which you purchase for a certain price per share. When you buy an individual stock, you also own parts of a company.

The earnings of the company are also divided into shares, so you make money when the company makes money. For example, if a company is worth $10 million and you paid $100 for one share, when the company earns $1 million in its next annual report, you will earn 50 cents per share on your original purchase.This is referred to as a dividend , and it’s one of the primary ways that companies reward their shareholders.

How to Find Dividends on Stocks

Finding dividends is simple, as long as you know a few basics about how shares are listed on online exchanges. Each exchange has its own requirements for share listings, but most are similar.

There are many different ways in which you can invest your money. You can invest in stocks, bonds, mutual funds, ETFs or other types of securities. You may have heard that some investments are riskier than others and this is true. The amount of risk you take on will depend on your investment goals and your appetite for risk.

Need help ? We are here to help, Contact us Now !